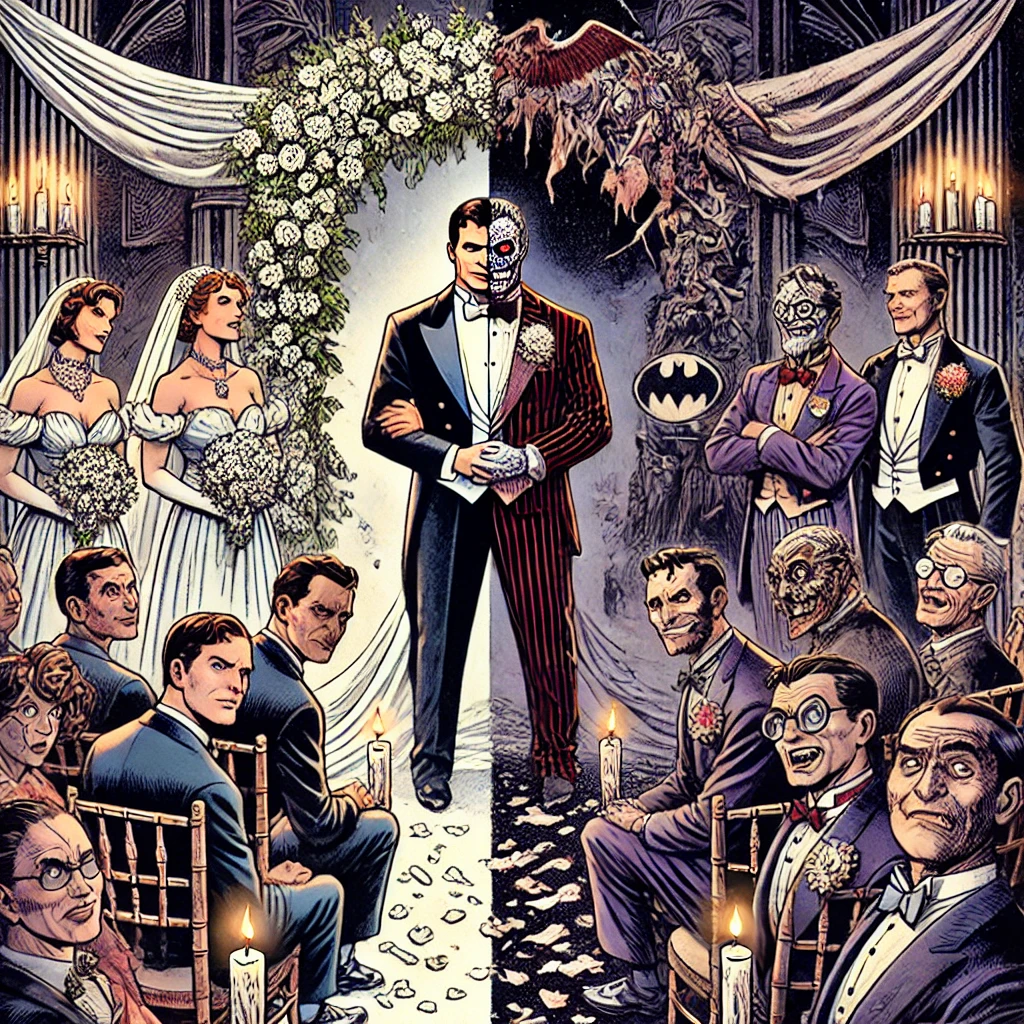

Gotham is a legal nightmare. Every week, some new ridiculous situation comes up that no tax code, legal precedent, or accountant could have possibly planned for. Case in point:

Harvey Dent wants to file a joint tax return.

With himself.

Yes, Two-Face thinks he should be able to file as “Married Filing Jointly” because, in his words, “there are two of us, and the IRS should respect that.”

I hate that I even have to look into this. But Gotham’s legal system is unpredictable, and I don’t put it past some bureaucrat to approve this just to get him off the phone. So, I did the research.

Can Two-Face File a Joint Return with Himself?

Short answer: No. But it’s Gotham, so it’s complicated.

The IRS has very clear rules about who qualifies for “Married Filing Jointly” status. To qualify, you need:

✔ A legal marriage – which Dent does not have (with himself or otherwise).

✔ A spouse – which, again, is not something you can just declare because you had a bad day at the coin flip.

✔ Two separate legal entities – which, despite his claims, Harvey Dent and Two-Face are still one person according to the law.

Even in Gotham, the IRS doesn’t recognize “multiple personalities” as separate tax entities. (I checked. And yes, I regret checking.)

Harvey’s Ridiculous Argument

Harvey Dent, being a former district attorney and a current pain in my ass, has come up with a few counterarguments:

1. “There are two of us.”

• Yes, but no. Legally, no. Just because he talks to himself and flips a coin for every decision doesn’t mean he gets to claim himself as a spouse.

2. “We should get double the deductions.”

• The IRS barely lets actual married people claim half the things they’re entitled to. They’re not about to start handing out extra deductions for criminals with identity issues.

3. “I can legally change my name to ‘Harvey Dent & Two-Face’ so it counts.”

• Changing your name doesn’t make you two people. Trust me. I tried registering “Batman” as a separate entity once for… reasons. The IRS didn’t like that either.

What Filing Status Can Two-Face Use?

Since the IRS doesn’t accept “split personality disorder” as a reason for a joint return, Harvey has two real options:

1. Single (The Right Choice, Even If He Hates It)

• He’s still one person, so he should file as Single like every other bachelor in Gotham.

• Yes, this means fewer tax breaks. No, this is not my problem.

2. Head of Household (If He Can Make a Convincing Case)

• If he somehow has a dependent (don’t ask me how), he might qualify for Head of Household status, which comes with better deductions.

• If his “dependent” is just his other personality, the IRS will laugh him out of the audit room.

Would the IRS Ever Approve This?

Normally, no. But this is Gotham, and I’ve seen weirder things happen. The IRS’s main concern is getting paid. If Harvey Dent (or both of him) is making money, they’ll tax it. If he tries anything too suspicious, he’ll get audited—which, in his case, means he’ll be arguing with himself in a room full of government agents.

I almost want to see that happen.

Final Verdict: Nice Try, Harvey

Harvey Dent, despite his obsession with duality, is still just one taxpayer. He doesn’t get to double-dip on deductions, and he definitely doesn’t get to file as Married Filing Jointly just because he refers to himself in the plural.

If the IRS let this slide, half of Gotham’s rogues’ gallery would be filing joint returns with their alter egos. And trust me, the last thing we need is the Joker trying to claim himself as a dependent.