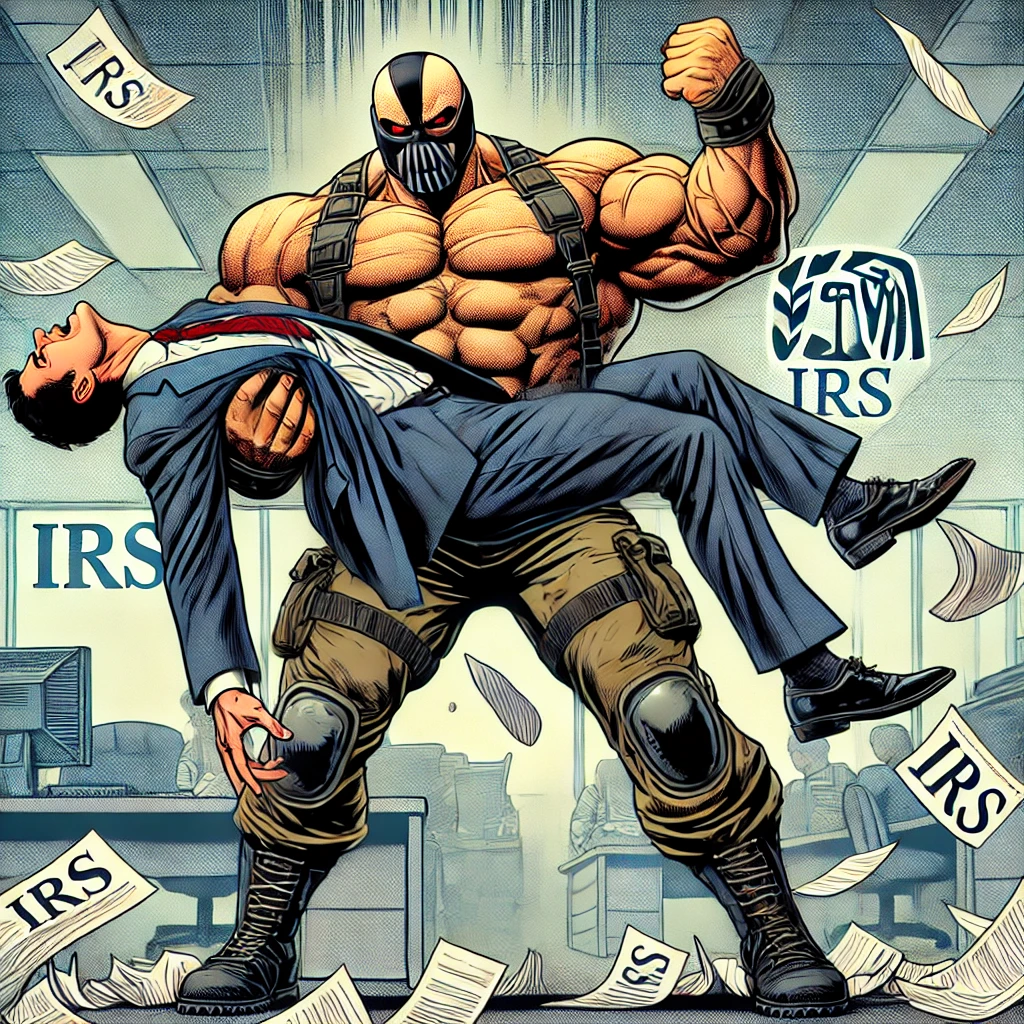

A guest column from Bane:

Ah, you think taxes are your ally. You merely adopted the tax code; I was born in it, molded by it. I did not see a deduction until I was already a man, by then it was blinding.

And now? I am the IRS’ reckoning.

You simple, pathetic taxpayers stumble into the same pitfalls every year, thinking you are immune to audits, penalties, and the crushing weight of compliance. But you are weak—and the IRS is stronger than you can possibly imagine.

So allow me, Bane, to educate you on how not to be destroyed by tax season. Though, let’s be honest, you probably won’t listen.

1. You Do Not Fear the Audit. But You Should.

The IRS is not some feeble, incompetent agency. No, it is a slow, lurking beast, waiting for you to become complacent. And yet, you underestimate it.

• You round numbers carelessly.

• You “guess” at deductions.

• You think cash payments are invisible.

But the IRS sees everything. It is always watching. And when it comes for you, it will not be merciful.

Avoidance Tactic:

✔ Keep receipts. You wouldn’t go into battle unarmed, would you? (Oh, but you would, you absolute fool.)

✔ Do not lie on your return. The IRS has math—you do not.

✔ If you are self-employed, track every expense or the IRS will crush you beneath self-employment tax.

2. You Think Tax Write-Offs Are Your Right. No. They Are a Privilege.

You delude yourself into thinking you can deduct anything. Oh, how amusing.

• Your “business lunches” are fraudulent.

• Your “home office” is a kitchen table.

• Your “charitable donation” was a GoFundMe for your friend’s failed podcast.

And yet, you believe the IRS will be generous?

Avoidance Tactic:

✔ Know the rules. A “business expense” must be ordinary and necessary. Unlike your subscription box for artisanal cheeses.

✔ Keep records. Saying “I totally had a business dinner” is not evidence.

3. You Think an Extension Means More Time to Pay. No. The IRS Waits for No One.

Oh, you filed an extension? You think you have bought yourself relief?

Fool.

A tax extension only delays the paperwork, not the reckoning. The IRS still demands its pound of flesh (read: money) on April 15th. If you fail to pay, they will unleash penalties upon you that will break you.

Avoidance Tactic:

✔ Pay on time. Or face the consequences. (And I assure you, the consequences will be severe.)

✔ If you owe, set up a payment plan. The IRS prefers its victims alive and paying, not bankrupt and useless.

4. You Ignore the IRS’ Letters. This Is a Grave Mistake.

Do you think you can simply ignore a letter from the IRS? That if you do not look upon it, it will cease to exist?

Laughable.

The IRS is not a telemarketer. It does not forget. It will send more letters, stronger letters. And when the time comes, it will take your wages, your assets, even your freedom.

Avoidance Tactic:

✔ Respond immediately. A letter means the IRS has noticed you. Do not make them notice you more.

✔ If you do not understand it, hire a CPA. Or perish.

5. You Treat Estimated Taxes Like a Suggestion. They Are Not.

Freelancers. Business owners. Independent warriors of capitalism. You think the IRS will not demand its due quarterly?

Oh, you will learn.

You ignore estimated tax payments. Then, in April, you are obliterated by penalties. Your debt has multiplied. And now? Now you are broken.

Avoidance Tactic:

✔ Pay quarterly estimates if you owe over $1,000.

✔ Use the IRS’ safe harbor rule to avoid penalties—or suffer.

Final Thoughts: The IRS Is Not Your Friend. It Is Inevitable.

The IRS is Gotham’s true overlord. You can flee from creditors. You can hide from bill collectors.

But the IRS will find you.

It is patient. It is relentless. It is the shadows in which I was born.

And if you fail to heed my advice? Well…

You have merely adopted tax season. But I was born in it.