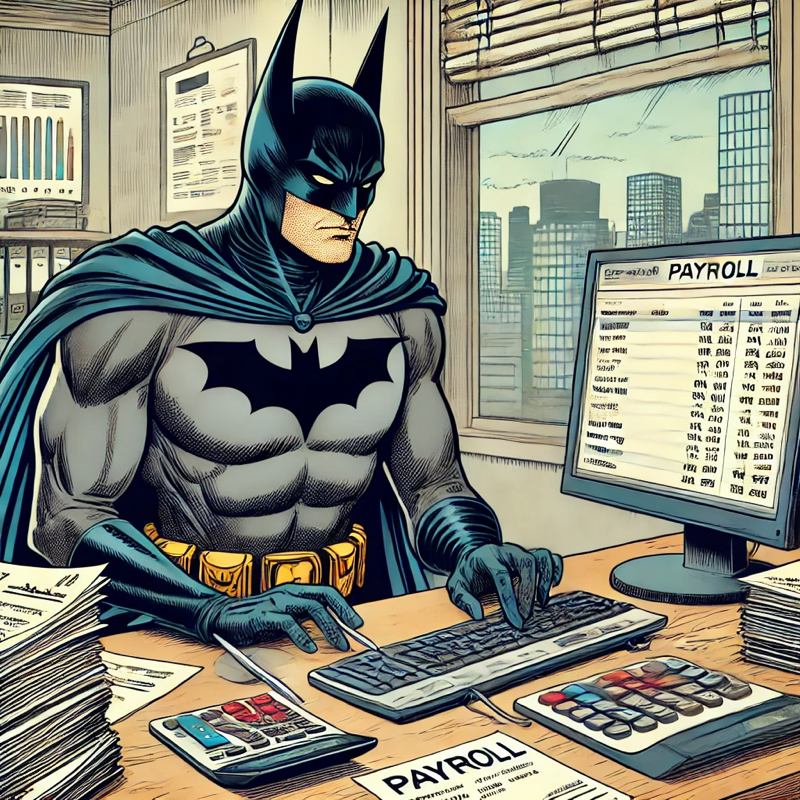

I’ve fought crime lords, supervillains, and forces beyond human comprehension. I’ve faced the worst Gotham has to offer. But nothing prepared me for the wrath of the IRS.

It started with a simple mistake—one I should have caught. In between night patrols, forensic investigations, and trying to recover from my disastrous options trading losses, I forgot to file Form 941 for Alfred. The quarterly payroll tax return. A legal requirement.

The IRS noticed. They always do.

The Damage

At first, I thought it was a minor oversight. Then the penalties hit like a Bane-sized punch:

• Failure to file – 5% of the unpaid tax per month, up to 25%.

• Failure to pay – 0.5% per month, stacking relentlessly.

• Interest – Compounded daily, a financial parasite draining my accounts.

Alfred was livid. I’ve seen him keep his composure through chemical attacks, city-wide blackouts, and even my worst injuries. But tax penalties? That was his breaking point.

Lucius Intervenes

Lucius Fox got involved before things spiraled further. He brought in the Wayne Enterprises accountants, who filed the overdue return and arranged a payment plan. Damage control. But even Batman can’t negotiate with the IRS. The penalties are non-negotiable.

The Lesson

This city has many enemies. Some fight in the streets. Others wear suits and operate within the law. The IRS is the latter. They don’t need masks or weapons—just deadlines and interest calculations.

So, let this be a lesson: No matter how busy you are, file your payroll taxes on time. Because even Batman can’t escape the long arm of the IRS.