I donate a lot of money. Wayne Enterprises has foundations, grants, and entire programs designed to help Gotham stay somewhat less terrible. And yet, every year, some tax law reminds me that just because I give money to a nonprofit doesn’t mean I get a deduction.

Which is ridiculous.

Apparently, the IRS doesn’t think all nonprofit donations qualify as “charitable contributions.” And as much as I hate it, they have rules. So before you write a check to your favorite organization and expect a tax break, read this.

Not Every Nonprofit Is a Charity

Just because an organization is labeled “nonprofit” doesn’t mean your donation counts as a charitable deduction. The IRS only allows deductions for donations to qualified nonprofits under Section 501(c)(3) of the tax code.

Other nonprofits might still be tax-exempt, but your contribution won’t be deductible if they fall under categories like:

• 501(c)(4) – Social Welfare Organizations (Example: Some civic leagues, advocacy groups)

• 501(c)(6) – Business Leagues & Trade Associations (Example: Gotham City Business Bureau)

• 501(c)(7) – Social Clubs (Example: That overpriced country club Bruce Wayne pretends to care about)

If you donate to one of these, congratulations—you helped them out, but you get nothing in return.

What Actually Qualifies for a Deduction?

For your donation to count as a charitable contribution, it must go to a 501(c)(3) organization with one of the following purposes:

✔ Religious – Churches, synagogues, temples, etc. (I once tried tithing 10% of the Wayne fortune just to test the system. Didn’t end well.)

✔ Educational – Schools, scholarships, research institutions.

✔ Scientific – Legitimate research, not “How Many Explosions Can Gotham Survive?”

✔ Public Charities – Homeless shelters, disaster relief, actual good causes.

Common Nonprofit Donations That Don’t Get You a Deduction

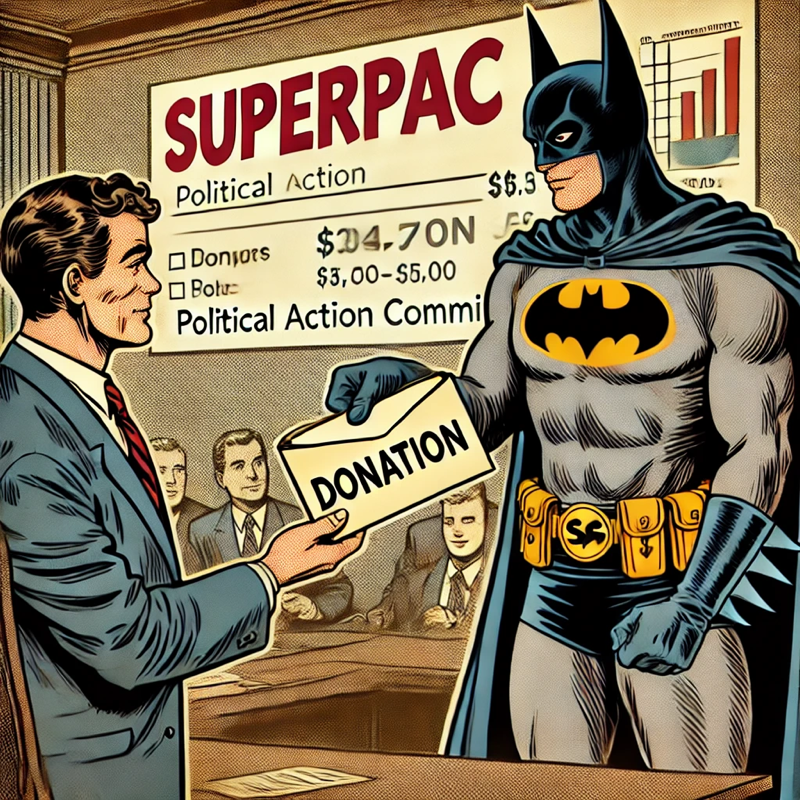

1. Political Contributions

💰 Giving money to a candidate or political action committee (PAC)? Not deductible.

• The Justice League once pooled funds to “encourage” a Gotham mayor to fund public safety. The IRS said nope.

• Even if a nonprofit is “advocating for change,” if they lobby or influence elections, you don’t get a tax break.

2. Membership Fees for Social Clubs

💰 Donating to a private club? Not deductible.

• If you pay dues to join something exclusive (like a private museum or elite club), it’s not charity—it’s a cover charge.

• I once “donated” to a high-end Gotham club to maintain appearances. IRS didn’t care.

3. Payments That Benefit You

💰 If you get something in return, your deduction is limited.

• Buying a $10,000 table at a charity gala? Only the portion above the fair market value of your meal is deductible.

• “Donating” to a school to get Robin into a better program? Not a deduction—just bribery with extra steps.

4. Donations to Foreign Charities

💰 Giving to a nonprofit overseas? Probably not deductible.

• Unless it’s an IRS-approved U.S. branch of an international nonprofit, your foreign donation doesn’t count.

• I once funded a relief mission in a foreign country. Great cause. Zero tax break.

5. Crowdfunding & Direct Assistance

💰 Giving money to a friend in need? Not deductible.

• If I set up a GoFundMe for Nightwing’s medical bills, that’s a personal gift, not a charitable contribution.

• If I write a personal check to a struggling hero, same problem.

How to Make Sure Your Donation Counts

✔ Check the nonprofit’s tax-exempt status. (Use the IRS Tax Exempt Organization Search tool.)

✔ Ask for a receipt. If they can’t provide one, red flag.

✔ Donate cash or property, not services. (Time and labor aren’t deductible.)

✔ If you receive something in return, subtract the value.

Final Verdict: The IRS Doesn’t Care About Your Good Intentions

You can give as much money as you want to whoever you want—but if you expect a tax deduction, you’d better play by the IRS’s ridiculous, bureaucratic, and joyless rules.

And yes, I will still donate millions to Gotham charities. But I will also grumble about every single IRS rule while I do it.